The Power of Clarity in Business

In business, clarity is power. One of the clearest and most impactful ways to gain that clarity is by understanding unit economics.

A few months ago, I worked with a service-based business offering massages, facials and other therapeutic treatments. From the outside, it appeared they were doing well. Clients were booking appointments, the team was busy, and the calendar was full. But underneath the surface, profitability was slipping and cash flow was tight.

That is when we turned to unit economics.

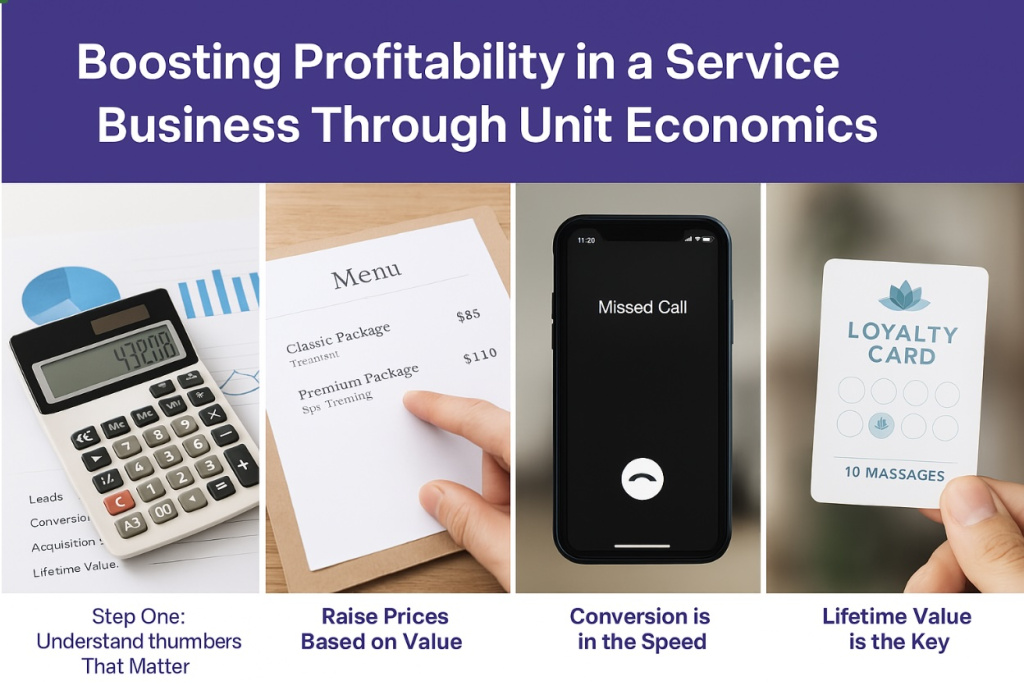

Step One: Understand the Numbers That Matter

The first thing I did was ask a series of simple but critical questions:

- What is your gross profit margin?

- How many leads are coming in?

- What is your conversion rate?

- What does it actually cost to acquire a client?

- What is the lifetime value of each client?

These are not just figures for the sake of reporting. They are the levers in your business. Once you understand them, you can pull the right ones to shift outcomes quickly. What we found was clear. They were pricing too low, spending too much to acquire clients, and missing the opportunity to retain those clients over the long term.

Raise Prices Based on Value

The first change we made was pricing. But we did not raise prices across the board. We focused on the services that consistently performed well—the ones clients returned for, regardless of price. We repositioned those services as premium experiences based on value, not cost.

The insight: People are happy to pay more when they believe they are getting more. Price should follow perceived value.

Conversion is in the Speed

Next, we tackled lead conversion. Their cost per acquisition was high. After reviewing their process, it became obvious that the problem was response time. Leads were coming in, but the team was too slow to respond. In today’s market, if you are not following up with a lead within ten minutes, you are almost certainly losing business.

We introduced a system that guaranteed fast responses and clearly communicated the benefits of each service. The result was a higher conversion rate and lower acquisition cost.

The insight: You may not need more leads. You might just need to convert the ones you already have, more effectively and more efficiently.

Lifetime Value is the Key

Finally, we looked at lifetime value. Instead of clients booking one session at a time, we encouraged them to purchase in packages—such as ten massages or a twelve-month wellness plan. This increased upfront revenue and created a predictable income stream.

It also built stronger client relationships because the focus shifted from single transactions to long-term results and value.

The insight: When you deliver long-term value, you create long-term revenue.

The Result

Within just three months, this business experienced:

- A noticeable increase in profitability

- Healthier and more consistent cash flow

- Improved client retention

- A team that finally understood the financial mechanics of the business

By aligning Shopify with Xero and automating transaction tracking, one client significantly reduced manual errors and uncovered $6,200 in missed GST credits across two quarters.

Here Is The Takeaway

Unit economics is not optional

It is the difference between guessing and growing with confidence.

If you are a business owner, become intimate with your numbers. Know your gross profit margin. Understand your cost to acquire a client. Measure how long your clients stay and how much they spend.

Once you see the system clearly, you can optimise it. And when you optimise the right levers, profitability improves fast.

Frequently Asked Questions

How do I start tracking unit economics for my business?

To begin tracking unit economics, you need to break down the key metrics such as gross profit margin, client acquisition costs, conversion rates, and lifetime value. Start by collecting data from your financial reports and customer records. Then, focus on improving the metrics that directly impact profitability, like reducing acquisition costs or increasing client retention.

Can I still work with my current bookkeeper?

If you’re just starting out, it can be tough to gather the data needed. Start small by tracking basic metrics like revenue, client acquisition costs, and retention rates. As you gather more data over time, you’ll be able to refine your analysis and make data-driven decisions to improve your profitability.

How can I apply unit economics to grow my business?

Once you understand your unit economics, use that information to make strategic decisions such as adjusting pricing, investing in marketing, or enhancing customer retention. The key is to use your data to create a balance between profitability and growth, ensuring that each dollar spent contributes to increasing the value of your business.

Ready to Simplify Your E-commerce Finances?

Whether you’re looking to optimise your pricing strategy, improve client retention, or better understand your unit economics – we’re here to help. Book a free consultation with our expert team at New Wave Accounting & Business Advisory, dedicated to supporting businesses across Australia.